Switzerland's international monetary cooperation

One of the core tasks of the International Monetary Fund (IMF) is to maintain and strengthen global financial stability. In order to achieve this, it works closely with the central banks and finance ministries of the member states. This cooperation also concerns the provision of resources to prevent or limit financial and currency crises.

Due to its openness to trade and capital flows, its own currency and its significant financial centre, Switzerland has a significant interest in being part of the global financial safety net. In particular, it participates in the international monetary cooperation mechanism within the framework of its IMF membership. In this context, the Federal Department of Finance (FDF) and the Swiss National Bank (SNB) work in close coordination in accordance with the following legal framework:

- Federal Act on Switzerland's Participation in the Bretton Woods Institutions of 4 October 1991

- Federal decree of 10 September 2020 on the approval of Switzerland's adhesion to the IMF's amended New Arrangements to Borrow

The Confederation may enter into financial obligations in accordance with the Monetary Assistance Act (MAA) and the Monetary Assistance Decree (MAD). The MAD puts this legal authorisation for monetary assistance into concrete terms and permits the assumption of default guarantees by the Confederation for assistance in accordance with Articles 2 and 4 of the MAA, up to a maximum of CHF 10 billion. The MAD is always limited to five years and was renewed for the last time in 2022 up to 15 April 2028.

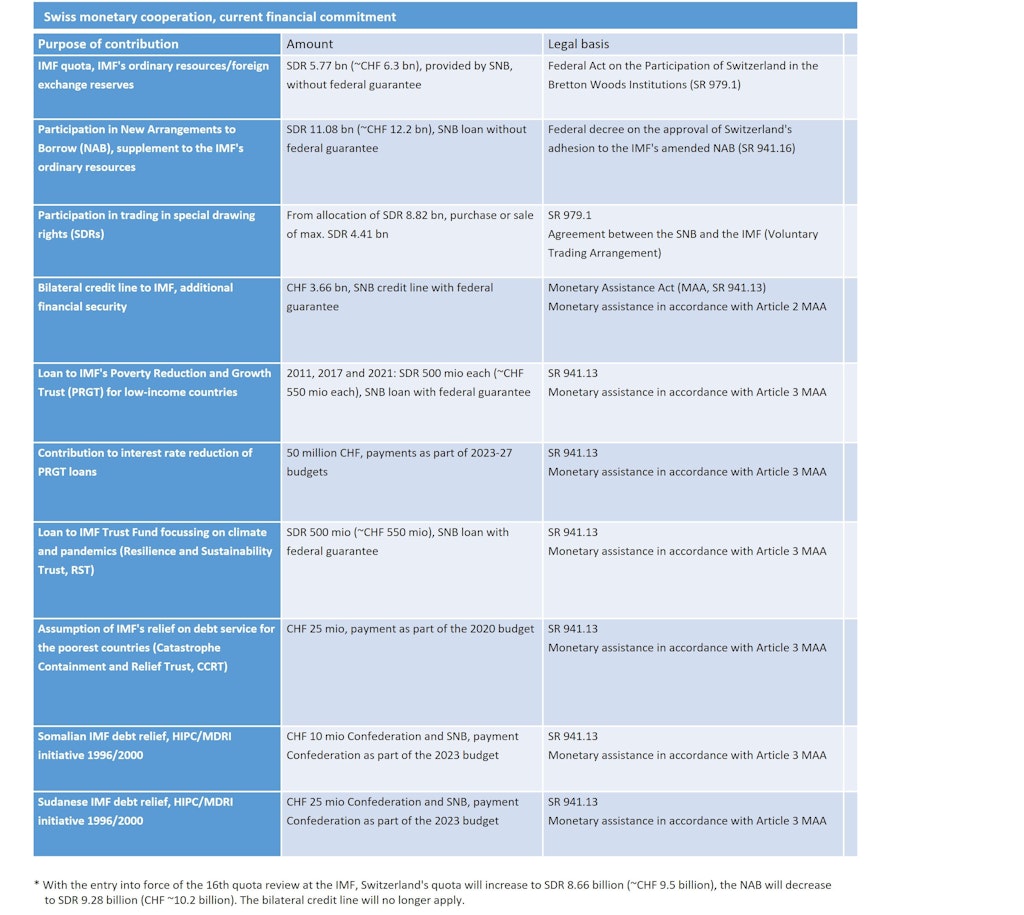

Switzerland's corresponding commitment includes the following contributions (data is mainly in Special Drawing Rights, the IMF's unit of account > Special Drawing Rights (SDRs), IMF website):

For information on Switzerland's relations with the IMF, please consult the Switzerland country page on the IMF website.

Main Dossier

Switzerland in the International Monetary Fund (IMF)

The main task of the International Monetary Fund (IMF) is to ensure the stability of the international financial and monetary system. Switzerland has an important voice in the IMF and is a reliable partner in initiatives to maintain global financial stability. As a constituency leader, it is permanently represented in the IMF Ministerial Committee and Executive Board, where it plays an active role. The IMF's almost universal membership with 191 countries gives it a high degree of legitimacy as a multilateral player.